Getting My Unicorn Finance Services To Work

They also gather and confirm every one of the essential paperwork that the lending institution needs from the customer in order to complete the residence purchase. A home mortgage broker generally deals with lots of various lending institutions as well as can supply a variety of loan choices to the debtor. A debtor does not have to collaborate with a home loan broker.

The 9-Second Trick For Unicorn Finance Services

While a home loan broker isn't necessary to facilitate the deal, some lending institutions may only function via mortgage brokers. If the lender you favor is amongst those, you'll need to make use of a mortgage broker.

Home mortgage brokers don't give the funds for finances or accept funding applications. They help individuals seeking residence loans to find a lender that can fund their house purchase.

Then, ask close friends, relatives, as well as business colleagues for references. Have a look at on-line reviews and also look for complaints. When meeting possible brokers, obtain a feeling for just how much interest they have in aiding you obtain the loan you require. Ask about their experience, the exact assistance that they'll supply, the fees they charge, and also just how they're paid (by loan provider or consumer).

Little Known Facts About Unicorn Finance Services.

Below are 6 advantages of using a mortgage broker. Home loan brokers are much more versatile with their hours as well as sometimes ready to do after hrs or weekends, conference each time and place that is convenient for you. This is a massive advantage for full-time employees or family members with commitments to take into consideration when intending to locate a financial investment residential or commercial property or offering up and carrying on.

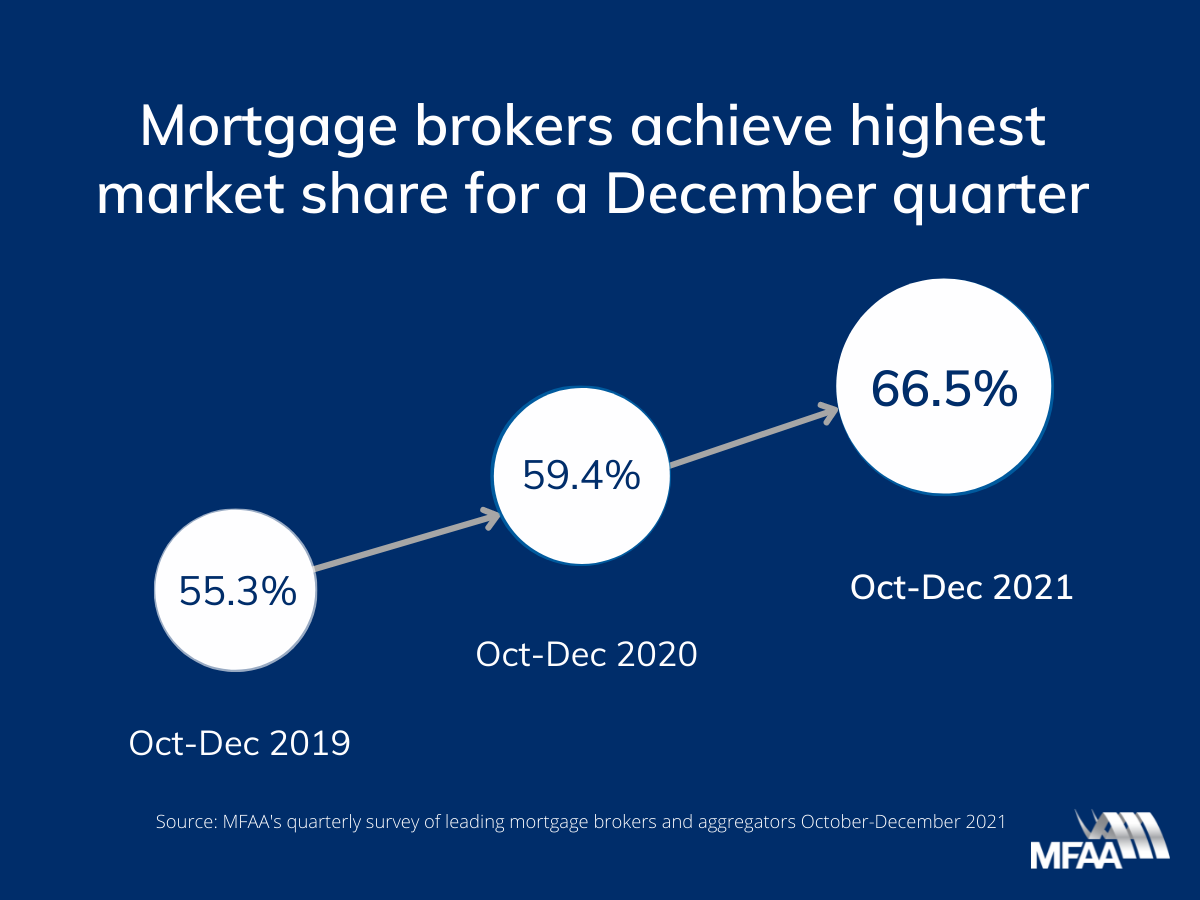

When you satisfy with a home loan broker, you are successfully obtaining accessibility to multiple financial institutions and also their lending options whereas a financial institution only has accessibility to what they are offering which may not be fit to your needs. As a home investor, discover a skilled home mortgage broker that is concentrated on giving property investment money.

Fascination About Unicorn Finance Services

This permits it to end up being very clear of what your borrowing power truly is as well as which loan providers are the most likely to offer to you. This helps you to identify which loan providers your application is probably to be effective with as well as lowers the chance that you'll be denied countless times and also marks versus your credit report history.

The majority of brokers (nevertheless not all) earn money on commissions paid by the lender as great site well as will only depend on this, providing you their services for free. Some brokers may make a higher payment from a specific loan provider, in which they might remain in favour of as well as lead you towards.

A great broker deals with you to: Comprehend your demands and objectives. Exercise what you can pay for to borrow. Find options to match your circumstance. Clarify just how each lending works as well as what it costs (as an example, rate of interest, features and fees). Make an application for a lending as well as handle the process with to settlement.

Some Known Details About Unicorn Finance Services

Some brokers earn money a standard cost regardless of what car loan they suggest. Other brokers get a higher fee for using specific car loans. Occasionally, a broker will charge you a charge directly rather than, or along with, the lending institution's commission. If you're unsure whether you're getting a bargain, ask around or look online to see what other brokers cost.

If the broker isn't on one of these checklists, they are running unlawfully. Prior to you see a broker, think about what matters most to you in a home lending.

Make a list of your: 'must-haves' (can't do without) 'nice-to-haves' (might do without) See selecting a mortgage for suggestions on what to consider. You can find an accredited mortgage broker with: a home mortgage broker expert organization your lender or banks recommendations from individuals you recognize Bring your list of must-haves as well as nice-to-haves.

Our Unicorn Finance Services Ideas

Obtain them to clarify just how each loan choice functions, what it sets you back and also why it's in your best interests. You don't need to take the first financing you're used. If you are not satisfied with any option, ask the broker to find options. You might prefer a specific lending institution, such as your present bank - https://www.quora.com/profile/John-Tran-794.